How will Roku’s job cuts and cost-cutting measures impact its future growth and revenue?

Roku’s job cuts and cost-cutting measures are expected to have a positive impact on its future growth and revenue. By reducing operating expenses and improving efficiency, Roku is positioning itself for long-term success. The consolidation of office space and the elimination of certain licensed content will help streamline operations and lower expenses. This, combined with the company’s focus on advertising revenue, will drive revenue growth. Despite the initial restructuring charges, these cost-cutting measures will ultimately contribute to Roku’s profitability and financial stability. Additionally, the increased revenue outlook for the third quarter further highlights the positive impact of these measures on Roku’s future growth and revenue.

What challenges does Roku face in the advertising market due to ongoing strikes in the entertainment industry?

The ongoing strikes in the entertainment industry pose challenges for Roku in the advertising market. With ad buys affected by the strikes, Roku may experience a temporary decline in ad revenue. However, Roku is well-positioned to navigate these challenges. The company’s strong market position and its ability to capture advertising dollars in the tech, media, and entertainment industries provide a competitive advantage. Roku’s focus on over-the-top distribution also gives it an edge in reaching audiences who may be impacted by the strikes. Additionally, the company’s diverse revenue streams, including partnerships and licensing deals, can help offset any declines in ad revenue during the strikes. Overall, while the strikes present temporary hurdles, Roku has the resources and strategy to overcome them.

How does Roku’s focus on advertising revenue differentiate it from other streaming companies?

Roku’s focus on advertising revenue sets it apart from other streaming companies. Unlike its competitors who primarily rely on subscription fees or hardware sales, Roku derives a significant portion of its revenue from advertising. This emphasis on advertising allows Roku to offer free content to its users while monetizing through ad placements. By capturing advertising dollars in the tech, media, and entertainment industries, Roku has demonstrated its ability to generate substantial advertising revenue. This diversified revenue stream is a key differentiating factor for Roku, enabling it to balance its business model and provide a unique streaming experience. Additionally, Roku’s strong market position and its continuous efforts to grow its active user base further enhance its advantage in the advertising market. Overall, Roku’s focus on advertising revenue positions it as a leader in the streaming industry, setting it apart from other companies in the market.

Full summary

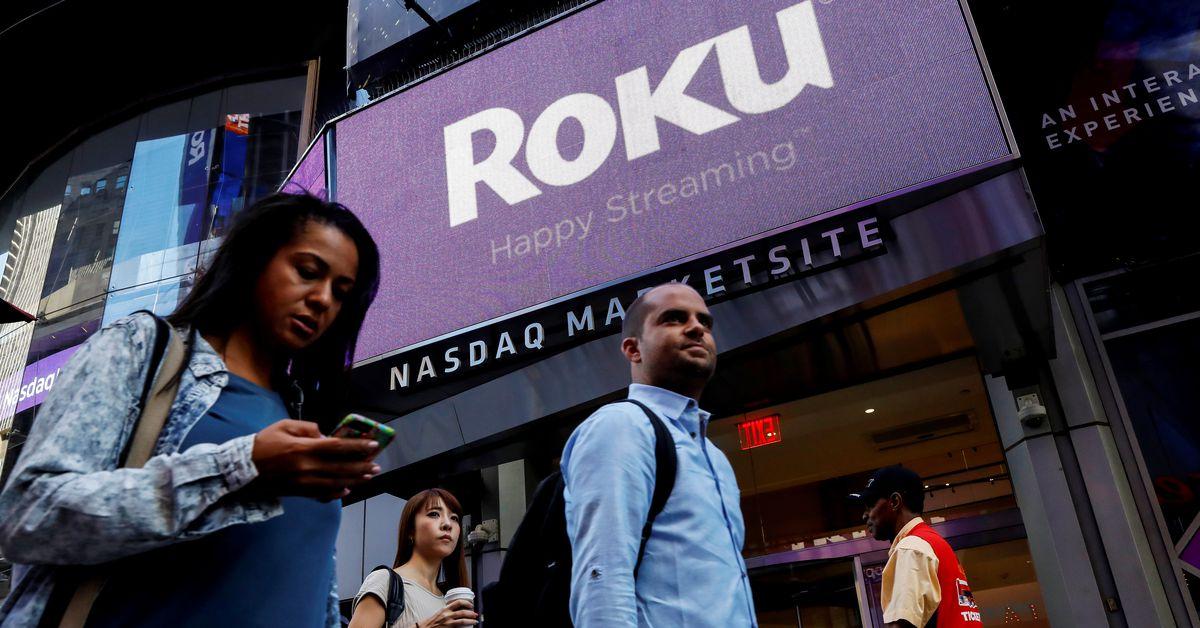

Roku, the streaming company, has made headlines with its recent announcement of job cuts and cost-cutting measures. The stock surged in premarket trading on Wednesday, fueled by the news of layoffs and an increased revenue outlook for the third quarter.

The streaming stock jumped 12.5% after announcing plans to lay off 10% of its staff. This decision marks the third round of workforce cuts in under a year. Roku aims to reduce operating expenses and improve efficiency by implementing measures such as consolidating office space, cutting back on expenses, and limiting new hires.

As part of the cost-cutting measures, Roku will cease using some office spaces and eliminate certain licensed content. These actions are expected to be complete by the end of the fourth quarter of fiscal 2023.

Roku's revenue is primarily derived from advertising, rather than hardware sales. However, the ongoing strikes in the entertainment industry have affected ad buys, posing challenges for Roku. Despite this, Roku expects a positive third-quarter revenue, with revenue projected to range between $835 million and $875 million.

The company's strong second-quarter results, driven by improved ad sales, have bolstered market sentiment. Roku posted market-beating results and saw its shares rise by 9%. With companies increasing ad spending and favorable consumer sentiment, Roku foresees continued growth in net revenue. The July-September period is expected to yield $815 million in net revenue, buoyed by sectors such as consumer products and health and wellness industries.

Roku is well-positioned in the advertising market, capitalizing on the shift from traditional linear distribution to over-the-top. By capturing advertising dollars in the tech, media, and entertainment industries, Roku's net revenue grew by 11% in the second quarter, reaching $847.2 million. The company also added 1.9 million active accounts, bringing the total to 73.5 million.

The consolidation of office space and the strategic review of the content portfolio are among Roku's measures to lower operating expense growth. These actions, along with other cost-cutting initiatives, aim to reduce expenses and streamline operations. Roku expects a restructuring charge of $45 million to $65 million, with the majority of charges incurred in the third quarter.

Amidst these changes, analysts maintain a positive outlook for Roku, with a consensus price target of $81.50 and a moderate buy consensus rating. Despite challenges in the ad spending landscape, Roku's shares have experienced an impressive 106% growth for the year.

Overall, Roku's announcement of layoffs and cost-cutting measures underscores its commitment to optimizing operations, reducing expenses, and driving long-term growth. The company's focus on advertising revenue and its strong market position make it a key player in the streaming industry.